You’re a few weeks into your new sales role, sitting in your first pipeline review.

Your manager is firing off questions like:

“What’s the multi-threading situation on the Curto deal?”

“Are we solid on the close date, or should we move it to best case?”

You nod like you understand, but internally you’re thinking:

- What’s a champion?

- What exactly are we forecasting?

- Did someone just say we need a MAP?

Welcome to sales, where everyone talks fast, uses acronyms like MEDDIC, and seems to speak a language you didn’t learn in onboarding.

The good news? It’s all learnable.

Like any high-pressure environment, sales runs on shared vocabulary. Once you understand the terms, the acronyms, and the frameworks, everything clicks faster.

And lucky for you, this guide breaks it all down!

Why This Guide Exists

This is a practical, field-tested playbook that explains the terms top reps use every day, from frameworks like MEDDIC to quickfire terms like “redlines” and “multi-threading.”

It’s designed for:

- New reps who want to get up to speed fast

- Intermediate sellers looking to sharpen their internal and external game

- Anyone who’s ever faked their way through a QBR (which stands for Quarterly Business Review, fyi).

How to Use It

Each section is broken down by theme, foundational terminology, acronyms, real-life sales lingo, and expert frameworks. You’ll get:

- Plain-English definitions

- When and where they show up (pipeline reviews, discovery calls, negotiation, etc.)

- Why they matter in real deals

- Quick examples so you can retain this stuff

Let’s get into it.

Core Sales Terminology (The Must-Know Foundation)

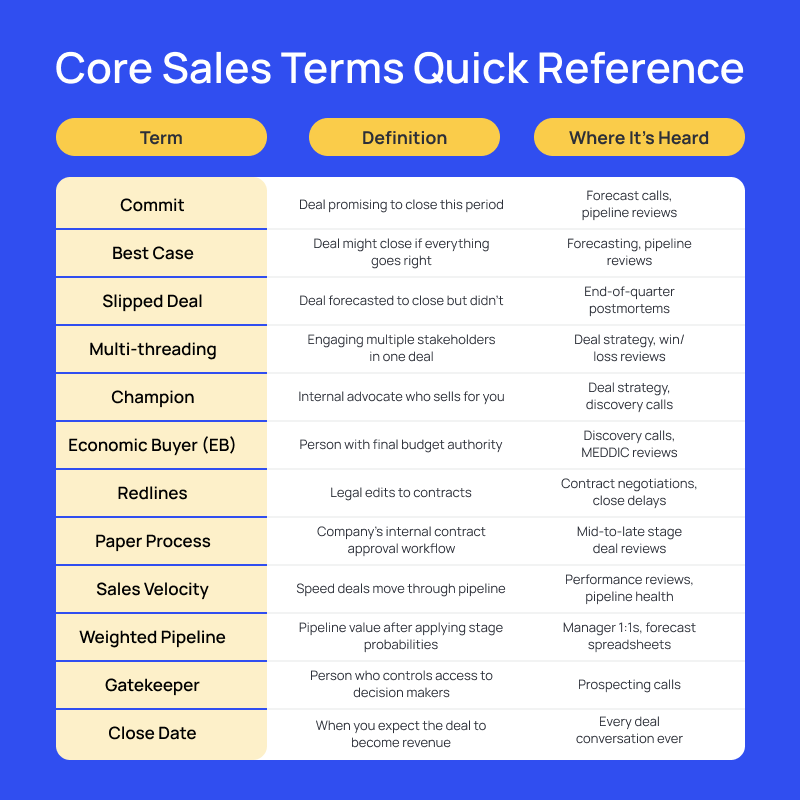

Before you worry about acronyms or frameworks, start here. These are the foundational terms you’ll hear in almost every sales conversation, especially in pipeline reviews, forecasting meetings, and Slack threads with your manager.

They’re essentially the backbone of how deals are tracked, reviewed, and judged.

1. Commit

What it means: A deal you’re personally promising will close by the end of the forecast period.

Where it shows up: Forecast calls, pipeline reviews, end-of-quarter panic mode.

Why it matters: Saying “commit” is like signing your name in blood. It means the rep, the manager, and maybe even the VP are betting on it.

Example: “I’ve got this at commit, we’ve got verbal approval from the EB.”

2. Best Case

What it means: A deal that might close this quarter if things go perfectly.

Where it shows up: Forecasting meetings, pipeline reviews. It's the "maybe" that keeps you up at night.

Why it matters: This is pipeline limbo, not dead, not certain.

Example: "Johnson Industries is best case. They love the demo, but procurement is still reviewing three other vendors."

3. Slipped Deal

What it means: A deal that was forecasted to close this period, and didn’t.

Where it shows up: End-of-quarter postmortems, forecast clean-ups.

Why it matters: One slipped deal isn’t the end of the world. But a pattern is a problem.

Example: "The TechStart deal slipped because their IT team got pulled into a security audit and couldn't evaluate our solution."

4. Multi-threading

What it means: Engaging multiple stakeholders in a deal, not relying on just one contact.

Where it shows up: Deal strategy sessions, win/loss reviews.

Why it matters: Single-threaded deals are fragile. If your one contact leaves or refuses, the deal dies.

Example: “We’ve got buy-in from ops, finance, and IT, this one’s multi-threaded.”

5. Champion

What it means: An internal advocate who sells you when you’re not in the room.

Where it shows up: Deal strategy, discovery calls.

Why it matters: A champion makes intros, shares internal info, and fights for you. It’s basically your way of fighting internal politics and the status quo.

Example: "Matt from IT is our champion. He's already pitched our solution to his boss and has invited the entire team to the demo call."

6. Economic Buyer (EB)

What it means: The person with final authority over budget and signing. Also sometimes called a decision maker.

Where it shows up: Discovery calls, MEDDIC

Why it matters: "The department head loves us, but the CFO is the economic buyer. We need to get in front of her before we can close."

7. Redlines

What it means: Legal edits to the contract or order form.

Where it shows up: End-stage deals, legal reviews, contract negotiations.

Why it matters: Redlines = delay risk. No matter how excited the buyer is, legal can stall everything.

Example: "Good news, only three redlines on the contract, and they're all minor. We should be able to close next week."

8. Paper Process

What it means: The internal process a company follows to approve and sign contracts.

Where it shows up: Mid-to-late stage deal reviews.

Why it matters: Paper processing can add weeks to your close date. Understanding it helps you forecast accurately and avoid last-minute surprises.

Example: “Their paper process includes InfoSec, procurement, and CFO approval, takes 2 weeks minimum.”

9. Sales Velocity

What it means: The speed at which deals move through your pipeline from first contact to closed-won.

Where it shows up: Performance reviews, pipeline health checks.

Why it matters: More velocity = faster revenue = lower CAC.

Example: "Our sales velocity is 90 days for mid-market deals, but enterprise deals take 180 days because of their complex approval process."

10. Weighted Pipeline

What it means: The value of your pipeline after applying probability weightings by stage.

Where it shows up: Forecast spreadsheets, manager 1:1s.

Why it matters: Raw pipeline is vanity. Weighted pipeline gives you and your manager a realistic view of what you'll close.

Example: “He’s got $800k in pipeline, but only $320k weighted, most of it’s still early stage.”

11. Gatekeeper

What it means: Someone who controls access to the decision-maker.

Where it shows up: Prospecting calls

Why it matters: Gatekeepers can make or break your sales effort. Don’t prioritize them, and you'll never reach the real buyer.

Example: "The executive assistant is a strong gatekeeper; he knows everyone's schedule and can get me five minutes with the VP if I explain the value clearly."

12. Close Date

What it means: The date you expect a deal to close and become revenue.

Where it shows up: Everywhere in sales. Pretty much every deal discussion.

Why it matters: Close dates drive everything, forecasts, quotas, commission payots, you name it.

Example: "The close date is March 15th. They want to start the implementation at the beginning of Q2."

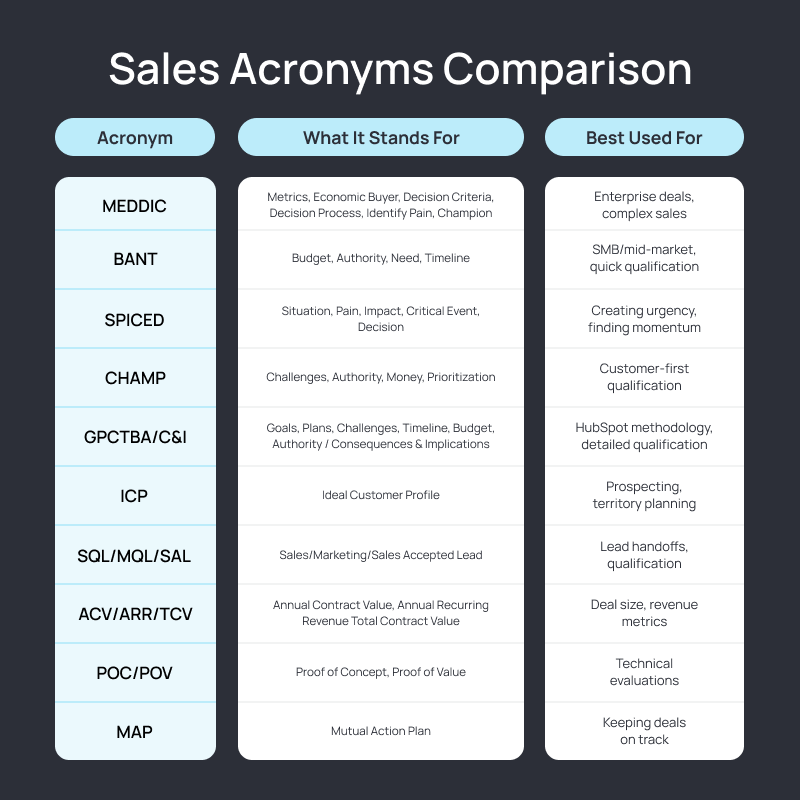

Sales Acronyms

Now that you've got the foundational terms down, you're ready to tackle the acronyms that make sales conversations sound like alphabet soup. Let’s go!

1. MEDDIC

Stands for: Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion

What it is: A deal qualification framework used heavily in enterprise/B2B sales.

Why it matters: MEDDIC deals close at higher rates because you've validated every critical component. It's the gold standard for enterprise sales qualification.

Example: "We're strong on MEDDIC, we know their success metrics, have the CFO engaged, understand their decision process, and our champion is pushing internally."

2. BANT

Stands for: Budget, Authority, Need, Timeline

What it is: An earlier-stage qualification framework that checks if a prospect has the money, power, problem, and urgency to buy.

Why it matters: BANT quickly filters out prospects who can't or won't buy, saving time for better opportunities. Great for SMB or mid-market sales.

Example: “They’ve got budget and urgency, but we’re unclear on authority, not fully BANT-qualified.”

3. SPICED

Stands for: Situation, Pain, Impact, Critical Event, Decision

What it is: A qualification method that emphasizes urgency and impact.

Why it matters: Helps reps find momentum. “Critical event” = what makes the deal happen now.

Example: "We SPICED the opportunity, their manual process costs $100K annually, and if they don't automate by Q4, they'll miss their efficiency targets.”

4. CHAMP

Stands for: Challenges, Authority, Money, Prioritization

What it is: A customer-first qualification framework, like a modern take on BANT.

Why it matters: CHAMP focuses on challenges first, making it easier to position your solution as the answer to their problems.

Example: "CHAMP shows they're struggling with customer retention, the CMO can approve the budget, they have $75K allocated, and it's their top priority this quarter."

5. GPCTBA/C&I

Stands for: Goals, Plans, Challenges, Timeline, Budget, Authority / Consequences & Implications

What it is: HubSpot’s comprehensive qualification framework.

Why it matters: Extremely in-depth, useful in long sales cycles or high-complexity deals.

Example: "Their GPCT is clear, they want to increase sales by 20%, plan to hire more reps, but they're challenged by lead quality and need a solution by Q2."

6. ICP

Stands for: Ideal Customer Profile

What it is: A clear description of your best-fit customer (industry, size, pain, etc.)

Why it matters: Helps reps prioritize outreach and focus on high-probability accounts.

Example: "This prospect fits our ICP perfectly. 200-person SaaS company, struggling with manual processes, growing fast, and has budget for tools."

7. SQL / MQL / SAL

Stands for: Sales Qualified Lead, Marketing Qualified Lead, Sales Accepted Lead

What it is: Lead status markers used in marketing-to-sales handoffs.

Why it matters: Helps sales and marketing teams align on lead quality and handoff processes.

Example: “That MQL never became a SQL, they weren’t ready to talk to sales.”

8. ACV / ARR / TCV

Stands for: Annual Contract Value, Annual Recurring Revenue, Total Contract Value

What it is: Different ways to measure deal size and recurring revenue over time.

Why it matters: They affect how deals are counted and how reps get paid.

Example: "The deal has $120K ACV, contributing to our $2M ARR target, with a $360K TCV over three years."

9. POC / POV

Stands for: Proof of Concept, Proof of Value

What it is: A trial or mini-implementation to prove your product works

Why it matters: Often required by larger buyers before purchase

Example: “We’re running a 14-day POC with their ops team to validate integrations.”

10. MAP

Stands for: Mutual Action Plan

What it is: A shared, step-by-step timeline for both the buyer and seller to get to close

Why it matters: Aligns stakeholders, prevents surprises, and keeps deals on track

Example: "Our MAP shows legal review by Friday, final demo next Tuesday, and contract signature by month-end."

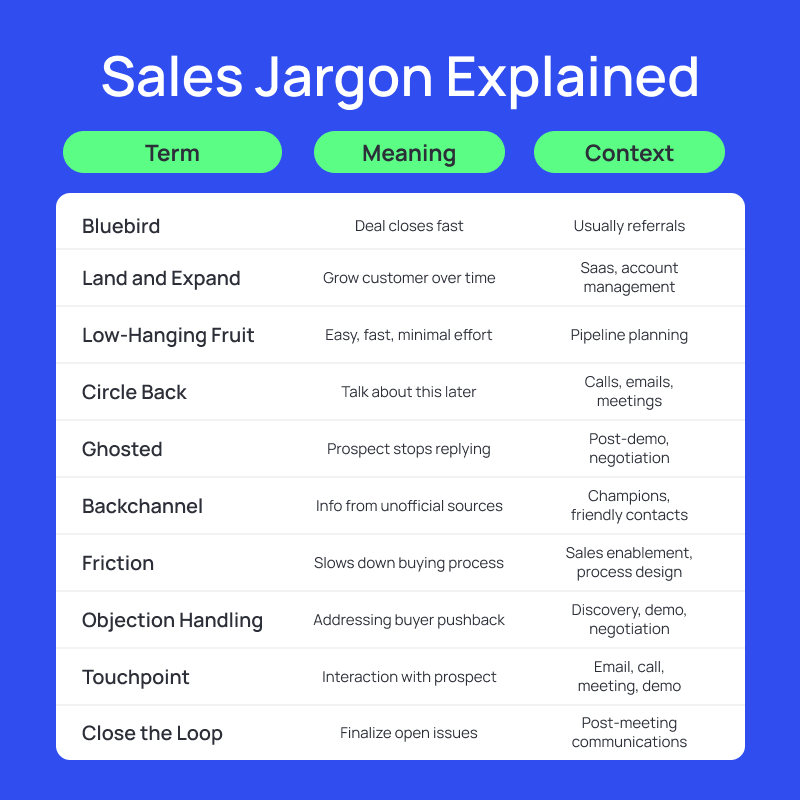

Sales Jargon You’ll Hear on the Floor

This is where we get into the everyday language reps, managers, and revenue leaders casually throw around in Slack, in 1:1s, and in forecast calls. Let’s get into it.

1. Bluebird

What it means: A deal that shows up unexpectedly and closes fast, out of nowhere.

Context: Usually a referral, inbound lead, or lucky timing.

Why it matters: They’re rare, so don’t build your quota plan around them.

Example: “That $80k renewal upsell? Total bluebird. Champion switched jobs and brought us in.”

2. Land and Expand

What it means: Strategy of starting small with a customer, then growing usage or footprint over time. Also called upselling

Context: Used in SaaS and account management playbooks.

Why it matters: Helps get a foot in the door with low risk, then grows ACV later.

Example: “We’ll land with 25 seats in Curto, then pitch them our higher-tier plan/more seats next quarter.”

3. Low-Hanging Fruit

What it means: An easy win, fast to close, minimal effort.

Context: Pipeline planning, prospecting.

Why it matters: Great for quick wins, but not always high value.

Example: “Focus on low-hanging fruit this week, we need deals to close fast.”

4. Circle Back

What it means: “Let’s talk about this later” or “I’m not ready to answer that.”

Context: Calls, emails, internal meetings.

Why it matters: Often used as a polite deferral, sometimes a soft no.

Example: “Good question, let me circle back once I check with legal.”

5. Ghosted

What it means: When a prospect goes silent and stops replying without explanation.

Context: Post-demo, negotiation, anytime really.

Why it matters: A major pipeline risk. Often means the deal wasn’t qualified or the momentum died.

Example: “We sent pricing and haven’t heard back in 2 weeks, pretty sure we got ghosted.”

6. Backchannel

What it means: Getting inside info from someone close to the deal but not formally in the loop.

Context: Champions, friendly contacts, exec relationships.

Why it matters: Backchanneling can surface blockers, politics, and deal risk early.

Example: “I backchanneled through our old contact in finance, they’re stuck on budget approval.”

7. Friction

What it means: Anything that slows down or complicates the buying process.

Context: Sales enablement, product gaps, process design.

Why it matters: Less friction = faster sales, happier buyers.

Example: “Requiring a credit check before trial is adding friction for SMBs.”

8. Objection Handling

What it means: The process of addressing buyer pushback (on price, timing, product, etc.)

Context: Discovery, demo, negotiation.

Why it matters: Top reps invite objections; they mean the buyer is thinking.

Example: “They said the price is too high, we need to handle that objection before the next step.”

9. Touchpoint

What it means: Any meaningful interaction with a prospect or customer.

Context: Email, call, meeting, demo, even a LinkedIn comment.

Why it matters: The more thoughtful the touchpoint, the better your odds of progressing the deal.

Example: “That demo call last quarter was a great touchpoint, got us back in the door.”

10. Close the Loop

What it means: Follow up, confirm, and finalize an open issue or question.

Context: Post-meeting, internal or external comms.

Why it matters: Drives clarity and momentum. Keeps deals from stalling.

Example: “I’ll close the loop with legal and confirm by Friday.”

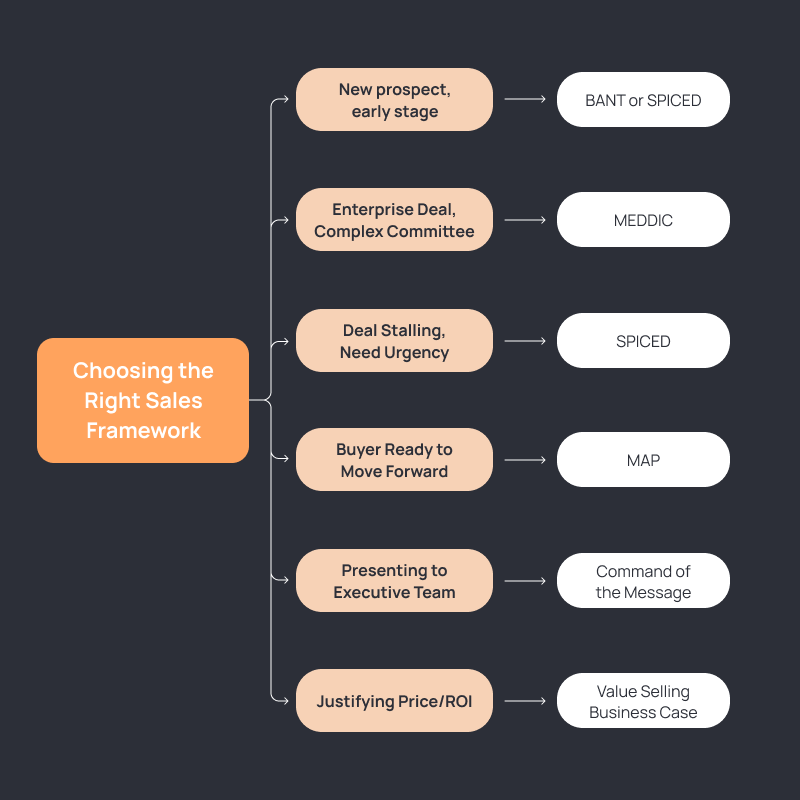

Sales Frameworks That Matter (And When to Use Them)

Sales frameworks are like operating systems for how you run your deals. They help you stay focused, ask the right questions, and avoid wasting time on tire-kickers and “I’ll circle back” dead ends.

Every great rep has one (or more) of these frameworks running in the background, whether they know it or not. Let’s break them down.

MEDDIC

You already know what MEDDIC stands for, but here's how to use it:

Metrics: What does success look like in numbers?

- "If we could reduce your customer churn by 15%, what would that mean for your revenue?"

- "What's your current cost per acquisition, and where do you need it to be?"

Economic Buyer: Who controls the budget?

- "Who ultimately approves purchases like this?"

- "When you bought your last solution, who signed off on it?"

Decision Criteria: How will they evaluate vendors?

- "What are the three most important factors in your decision?"

- "How will you measure success in the first 90 days?"

Decision Process: What's their buying process?

- "Walk me through how you made your last software purchase."

- "Who else needs to be involved in this decision?"

Identify Pain: What's broken that they need to fix?

- "What happens if you don't solve this problem?"

- "How is this impacting your team right now?"

Champion: Who's selling for you internally?

- "Who else should I be talking to about this?"

- "Is there someone who could help me understand the technical requirements?"

When to use MEDDIC: Complex, enterprise deals with long sales cycles. If your average deal is $50K+ and takes 3+ months, MEDDIC is your friend.

BANT vs. MEDDIC: When to Use Each

Use BANT when:

- SMB/mid-market deals ($5K-$50K)

- Shorter sales cycles (under 3 months)

- Single decision maker

- Transactional sales

Use MEDDIC when:

- Enterprise deals ($50K+)

- Complex buying committees

- Long sales cycles (3+ months)

- Multiple stakeholders

Example: "For our $10K deals, I qualify with BANT, quick and dirty. For enterprise deals, I go with MEDDIC because there's too much at stake to guess."

Mutual Action Plan (MAP) Framework

What it is: A shared timeline with both buyer and seller commitments.

How to build one:

- Discovery phase: "By Friday, you'll send me your technical requirements, and I'll send you our security documentation."

- Evaluation phase: "Next Tuesday, we'll do the technical demo. Your IT team will test the integration by Thursday."

- Decision phase: "Your procurement team will review our proposal by the 15th. We'll have redlines back by the 20th."

- Close phase: "Final signatures by month-end so you can start implementation in Q2."

Why it works: Creates accountability on both sides and prevents "we're still reviewing" limbo.

Command of the Message

What it is: A framework for positioning your solution around the customer's business issues, not your features.

The structure:

- Unconsidered Need: What problem don't they know they have?

- Required Capabilities: What must any solution do to solve this?

- Your Differentiators: Why are you uniquely positioned to solve it?

Example: "Most companies think they need better reporting (their considered need), but the real issue is data silos preventing real-time decision making (unconsidered need). Any solution needs to integrate with your existing systems seamlessly (required capability), and we're the only vendor with pre-built connectors to your ERP system (differentiator)."

Value Selling Framework

What it is: A broad methodology focused on selling outcomes and return on investment rather than features and functions.

When to use it: Throughout the sales process, especially late stage.

Why it matters: Buyers don’t care what your product does. They care what it does for them. Value selling aligns the deal to real business impact.

Pro tip: Always quantify pain in dollars if you can. Turn a “manual process” into “$12k/month in wasted time.”

SPICED Overview

When to use SPICED: When you need to create urgency and find deals that will close this quarter.

Situation: What's their current state?

Pain: What's not working?

Impact: What happens if they don't fix it?

Critical Event: What's driving urgency?

Decision: What's their buying process?

The magic question: "What happens if you don't solve this by [specific date]?"

Exit Criteria per Stage

These are specific conditions that must be met to move a deal from one stage to the next in your CRM.

Discovery Stage Exit Criteria:

- Pain clearly identified and quantified

- Budget range confirmed

- Key stakeholders mapped

- Timeline established

- BANT/MEDDIC partially complete

Demo/Evaluation Stage Exit Criteria:

- Technical fit confirmed

- Value proposition resonates

- Champion identified

- Next steps agreed upon

- Proposal requested

Negotiation Stage Exit Criteria:

- Proposal submitted and reviewed

- Pricing discussions started

- Legal/procurement engaged

- Implementation timeline discussed

- Contract terms being negotiated

Close Stage Exit Criteria:

- All stakeholders aligned

- Contract redlines minimal

- Signatures scheduled

- Implementation team introduced

- Success metrics agreed upon

Discovery Frameworks

The 3 Whys Method:

- First Why: "Why are you looking at solutions like this?"

- Second Why: "Why is this important to solve now?"

- Third Why: "Why would you choose us over the status quo?"

The SPIN Technique:

- Situation: "Tell me about your current process."

- Problem: "What challenges are you facing?"

- Implication: "How does this impact your business?"

- Need-Payoff: "What would it mean if we could solve this?"

The Before/After Method:

- "Describe your ideal future state."

- "What does your world look like today?"

- "What needs to change to get there?"

Framework Selection Guide

Use this flowchart to pick the right framework:

Cheat Sheet: Quick Reference Table

Print this out.

Pin it to your monitor.

Screenshot it for your phone.

This is your go-to reference when you're in the middle of a call and can’t remember what SPICED means.

TL;DR: Your Sales Language Toolkit

Three weeks ago, you were nodding through pipeline reviews, silently Googling “multi-threading” after the call.

Now? You’ve got the chops to not just keep up, but steer the conversation.

That fluency will come with practice. Until then, keep this guide close. Revisit it, reference it, and share it with your team.

Now that you know how to spot the real deal, the next step is filling your pipeline with leads worth qualifying.

That’s where Salesflow comes in, a simple, five-step outreach system built for reps who want to skip the guesswork and get straight to selling.

Try us free, and see how much faster deals close when the busywork's off your plate.

FAQs:

.svg)